See how it works

Other benefits of Manulife One

One of the first lessons that most of us learn about money is “Prepare for the unexpected.” In fact, most financial advisors suggest keeping three to six months of income in a 'rainy day' account. While preparing for the unexpected is certainly good advice, it’s worth looking at how we do this to ensure we’re making the best use of our money.

Many of us choose to set aside money in a savings account. But what if we also have debt? We almost always pay more interest on our debt than we earn on our savings. Wouldn’t our money work harder if we used our savings to reduce our debt?

We’re often reluctant to do this because we don’t want to lose access to that money. So we’re forced to choose - pay down our debt or prepare for the unexpected. With Manulife One, you don’t need to choose.

Manulife One allows you to combine your debt and savings into an efficient all-in-one account. Your savings work to reduce your debt, saving you interest. Then, if a need arises, you can always access that money again, up to your borrowing limit.

You shouldn’t have to choose between paying down your debt and preparing for the unexpected. With Manulife One, you can do both.

Investing in real estate can be an attractive and effective way to build wealth but it takes a lot of time and energy to manage the financial aspect of your investment. Manulife One can simplify all that and provide you with easy access to the equity you’ve accumulated in your property.

It can help you manage your investment properties by:

- Tracking expenses - Manulife One combines your mortgage with your chequing account, so all of your rental expenses and income can be managed from a single account. This makes it easy to track interest and maintenance costs for taxation purposes.

- Accessing equity - use the equity accumulated in your investment property (up to your borrowing limit) to finance repairs, purchase additional properties or address other financial needs.

- Accelerating your debt repayment – have your rental income flow directly into your Manulife One account This can potentially pay down your debts faster and save you thousands of dollars in interest costs.

Manulife One is available for a broad range of investment properties including:

- single-detached homes;

- townhouses;

- duplexes/triplexes/fourplexes; and

- condominiums.

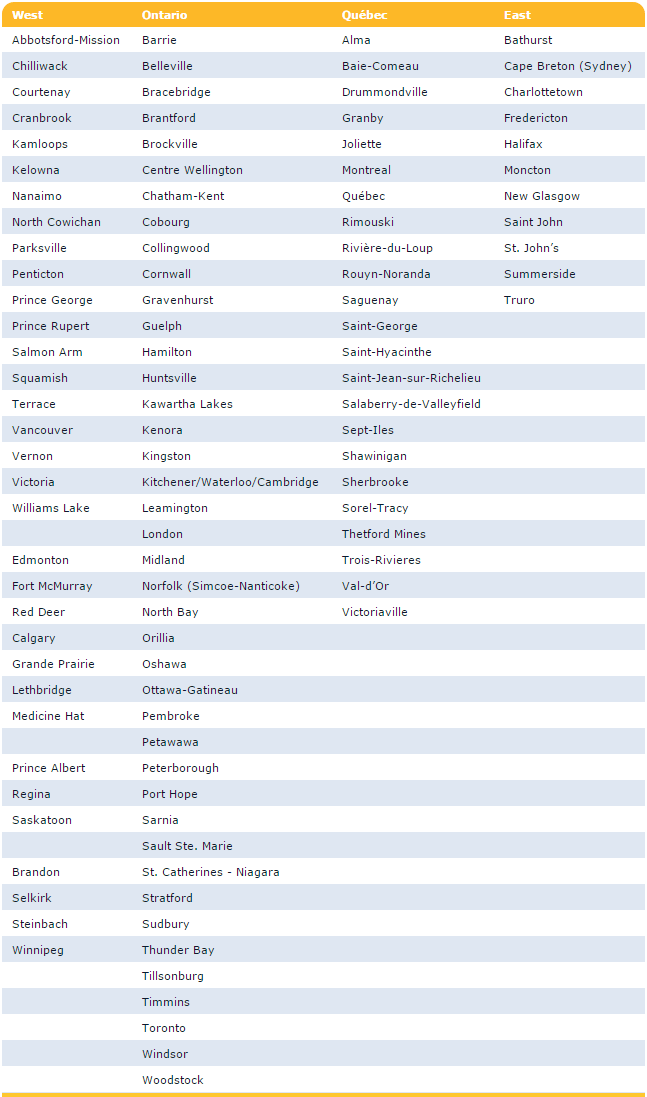

Eligible Communities

The Manulife One account for owner occupied investment properties is available across Canada, excluding the territories. Manulife One for non-owner occupied investment properties is available in the following communities:

An important part of effective retirement planning is including flexibility - so you can address unexpected expenses that inevitably will arise, without sacrificing your retirement dreams.

Manulife One is a revolutionary banking solution that can give you that financial flexibility.

Why financial flexibility is important

As Canadians approach and enter retirement, we typically arrange our finances so that we have a stable income from month to month. However, we often don’t fully prepare for the fact that we may not have stable expenses in retirement. Sometimes life throws “what ifs” your way.

Preparing for “what ifs”

In addition to regular month-to-month fluctuations in expenses, you may encounter larger, one-time expenses: What if I have unexpected medical expenses? What if I need to help one of my children? What if the house needs a major repair? You don’t want the worry or disappointment of unexpected costs – such as medical expenses or home repairs – derailing your plans.

And how about unexpected opportunities: What if your friends invite you to join them on a cruise? What if your daughter is accepted to graduate school? After working diligently for years and building your personal equity, you want to be able to take advantage of great opportunities when you have the chance.

Manulife One is an all-in-one savings, chequing and borrowing account that is secured by the equity you’ve established in your home. Because you have control over how you manage the account, you have access to this equity, up to your borrowing limit, whenever a need arises.

Banking…on your terms

With Manulife One, accessing your home equity is as easy as writing a cheque, transferring money to another account or even using your bank card. With a Manulife One account, you may never need to apply for a bank loan or arrange financing again. You decide when and how you access the equity that you’ve worked hard to build and maintain over the years. Now that’s true financial flexibility.

The solution for variable income

Many independent business owners have a variable income – abundant one month, less so the next. However, most monthly expenses remain fairly consistent. This can mean that some months you’re finding creative solutions for meeting your financial needs – take a little out of this account, move it to that account until that payment comes in and then move it back and pay that bill a little later. This can be added money management (and stress) you don’t need.

Because of its all-in-one design, Manulife One could even out your income stream and reduce the hands-on account management necessary each month.

On your own terms

With Manulife One you are the banker – you decide how much to borrow, up to your borrowing limit, and how quickly to repay your principal. You can even track different portions of your debt separately with the sub-account feature. If you would like to make a significant purchase, outside of your monthly expenses, and you have the room within your borrowing limit, there’s no need to apply for a loan. You simply write a cheque.

If you have successfully run your small business for at least two years, getting started with Manulife One is easy. If you have a good credit history and your income taxes are up-to-date, you could be eligible to borrow up to 65% of the appraised value of your home.