How Manulife Bank Select Works

Manulife Bank Select combines a mortgage with a high interest, full feature chequing account to bring your banking together in one convenient product.

Enjoy the benefits of splitting your mortgage into as many as five different portions in order to:

- Manage your risk around rising interest rates

- Lower your effective interest rate

- Enjoy the best of both worlds with fixed and variable interest rates

- Track a portion of your mortgage for tax purposes

- Reduce your mortgage renewal risk

With each portion of your mortgage you can choose from a variety of options:

- Choose between the security of a fixed rate mortgage or the lower cost of a variable rate mortgage:

- Fixed means the interest rate you pay stays the same for a specified term.

- Variable means the interest rate you pay varies with market trends but, your payments stay the same.1

- When rates go down, more of your payment goes towards paying off your mortgage principal.

- When rates go up, a smaller portion goes towards the principal.

- Choose between an open or closed mortgage:

- An open mortgage allows you to pay off any or the entire mortgage at any time without penalty.

- A closed mortgage allows annual prepayment privileges.

- Choose the length/term of your mortgage:

- Fixed-rate closed terms - 6-month, 1-5 years, 7-years or 10-years

- Fixed-rate open terms - 1-year

- Variable rate terms - 5-years (open & closed)

- Choose the payment schedule that suits your income and monthly cash flow needs. You can choose to make payments:

- Weekly (52 payments/year)

- Weekly accelerated (52 payments/year but at a higher amount than weekly)

- Bi-weekly (26 payments/year)

- Bi-weekly accelerated (26 payments/year but at a higher amount than bi-weekly)

- Semi-monthly (24 payments/year)

- Monthly (12 payments/year)

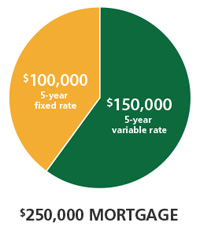

Steve and Melissa have a $250,000 mortgage. They like the low variable mortgage rates that are currently available but they don’t think they’re going to last. They want to take advantage of this low rate now but would like some stability if rates rise.

Their Banking Consultant recommends they split their mortgage into two portions: $150,000 in a 5-year variable rate and $100,000 in a 5-year fixed rate.

By dividing their mortgage into portions, they’re able to take advantage of the lower variable interest rates on part of their mortgage. And, by having a portion of their mortgage in a 5-year fixed term, they’ve reduced the potential increase to their overall payments if interest rates go up.

Save money and be mortgage-free sooner with some of the most flexible annual prepayment privileges in Canada. These include:

- Make lump-sum payments up to 20% of your original mortgage portion amount.

- Increase your regular mortgage portion payment by up to 25%.

If you choose to split your mortgage into portions, the prepayment privileges still apply to any and all of the portions.

For closed terms, a prepayment charge would apply for prepayment greater than the privileges noted above.

Enjoy the flexibility of a daily banking account while earning a high rate of interest on every dollar in the account, every day. You can use it to:

- Receive direct payroll deposits

- Pay bills via online or telephone banking (including pre-authorized bill payments)

- Write cheques

- Use the Manulife Bank Mobile app, including mobile deposit

- Make deposits3 and withdrawals from ABMs4

- Make direct debit payments in stores (including getting cash back)

- Make your mortgage payments

- And much more!

Isn’t it time your banking came together? Join the Manulife Bank Select family today.

1 If the interest charge exceeds the payment, you will be required to increase your payment amount.

2 The illustration assumes a 5-year fixed rate of 3.50% and an initial 5-year variable rate of 2.90% which increases 0.25% per year of the term and an amortization period of 25 years.

3 Deposits can be made to any ABM that displays THE EXCHANGE® logo

4 Withdrawing funds from an ABM that is not part of THE EXCHANGE® network may result in fees being incurred. Fiserv EFT is the owner of THE EXCHANGE® trade mark and its associated rights. Fiserv EFT has granted FICANEX® the exclusive right to use, market and sublicense THE EXCHANGE® trade mark and the intellectual property rights associated with the operation of THE EXCHANGE® Network throughout Canada. Manulife Bank of Canada is an authorized user of the mark.